In Japan’s cashless ecosystem, PayPay sits near the top for day-to-day payments, utility bills, and online checkouts.

Searches for PayPay Registration for Foreigners in Japan usually boil down to two tasks: creating a verified PayPay account and, optionally, linking a PayPay Card for higher earn rates and campaign access.

Verified accounts unlock bank top-ups and transfers, while PayPay Card brings consistent point accrual and full 3D Secure protection. Facts, rates, and program rules below reference official PayPay and PayPay Card materials verified in 2025.

Who Can Register and What Documents are Accepted

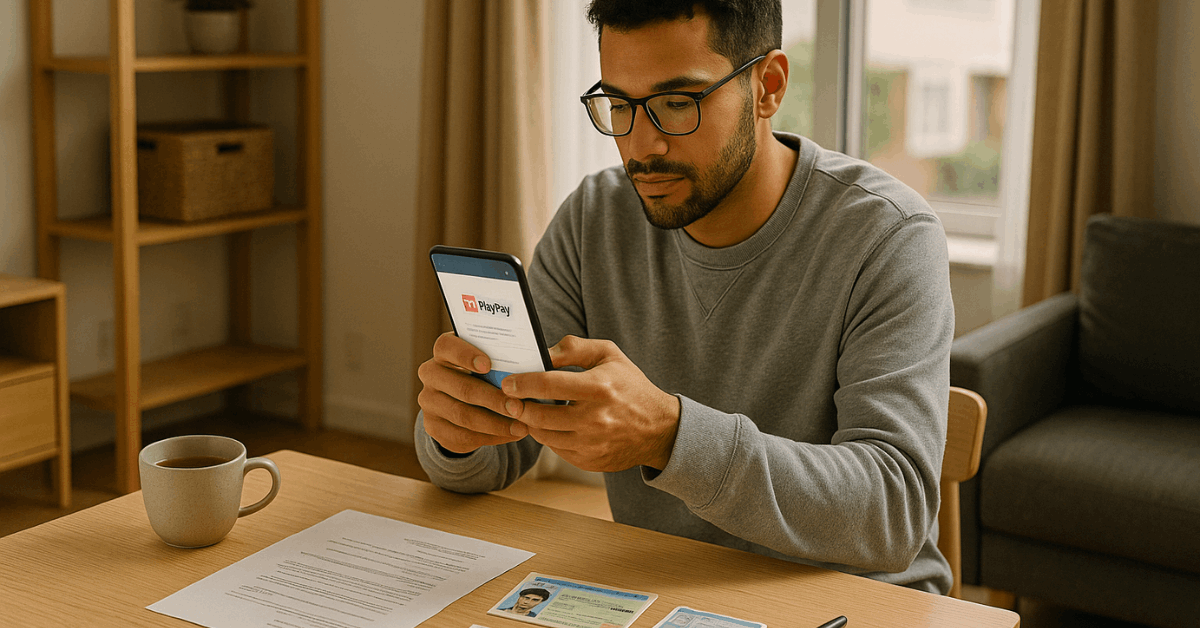

Foreign residents in Japan can complete PayPay’s identity verification through the app.

Accepted eKYC documents include a My Number Card, Japanese driver’s license, Residence Card, and the Special Permanent Resident Certificate; these are scanned or read via NFC depending on the method used. Phone number verification by SMS occurs during sign-up.

Accepted Identity Options:

| Document | Notes |

| My Number Card | NFC eKYC supported for fast verification. |

| Driver’s License | Standard eKYC flow. |

| Residence Card | Supported for foreign residents. |

| Special Permanent Resident Certificate | Supported. |

| Disability/Support Handbooks | Accepted where listed in PayPay help. |

How to Register in The App: Step-By-Step

Getting through first registration feels quick once the required items are ready. Follow the flow below and keep the same legal name across steps to avoid mismatches.

- Install PayPay, open the app, and complete phone number verification then choose Google sign-in or carrier options if preferred.

- Start identity verification (本人確認), pick the document type, and finish the guided eKYC capture.

- Link a Japanese bank account that supports online registration; several major banks enable same-day completion.

- Enable PayPay eKYC status to unlock bank top-ups, transfers, and PayPay Money features.

Optional: add PayPay Card and switch the payment setting to “Credit” inside the app when eligible.

PayPay Balance Types and What They Unlock

PayPay operates two core balance types. Verification status determines which functions activate and whether funds can be sent out.

| Feature | PayPay Money | PayPay Money Lite |

| Bank top-up & bank transfer out | Available after identity verification | Not available |

| Bill payment & taxes | Available | Limited eligibility |

| How it becomes this type | Post-verification top-ups or eligible inflows | Pre-verification top-ups, card or carrier top-ups |

| Notes | Type does not retro-convert from Lite after verification | Designed for spending, no withdrawal |

Linking A Bank Account or PayPay Card

Most large institutions appear in PayPay’s bank list, and entries labeled “Online Available” allow fully digital setup that can complete the same day.

Linking enables direct top-ups and smooth bill payments inside the app.

When a PayPay Card is later added, card details can be viewed securely in-app as a numberless card, revealed behind biometric or SMS authentication to reduce exposure of static numbers.

Adding PayPay Card and PayPay Credit

Simple in-app steps connect PayPay Card and enable PayPay Credit for blue “Credit” checkout screens.

- Open the barcode screen, swipe to “Credit,” and consent to information handling prompts.

- Enter required profile fields; some auto-fill when identity is already verified in PayPay.

- Choose the brand and register the settlement account used for PayPay Credit.

- Finish review; the app flips to “Credit” mode for PayPay payments after approval.

- Configure 3D Secure to protect online transactions; one-time codes or app prompts complete the check.

Rewards, Campaigns, and 2025 Changes

Baseline point accrual on PayPay Card is 1.0%, while PayPay Card Gold reaches up to 1.5%; an extra +0.5% applies in months after meeting the PayPay Step conditions of at least 30 payments of 200 yen or more and total spending of 100,000 yen in the count month. Calculation is per 200 yen.

Yahoo Shopping PayPay Points

Daily shopping stacks continue on LINE Yahoo services. Yahoo Shopping PayPay points promotions offer everyday 5% on Yahoo! Shopping and LOHACO, and LYP Premium adds more; however, starting February 1, 2025 some components are issued as PayPay Points (limited time) that expire, so plan redemptions accordingly.

SoftBank Y!mobile Rewards

Telecom tie-ins remain strong. SoftBank Y!mobile rewards integrate with PayPay Card Gold for higher earn on eligible lines when proper account linkage is completed; plan-level differences and exclusions apply, so verify the exact rate for the subscribed plan.

PayPay Card Gold Benefits that Help Frequent Travelers

Residents flying domestically or via Hawaii get lounge access by showing PayPay Card Gold and a same-day boarding pass; family cardholders also qualify for free entry on their own card. Purchase protection and travel insurance are bundled to Gold specifications.

Drivers looking to add toll functionality can request an ETC card Japan add-on.

The ETC card annual fee is 550 yen per card on the standard PayPay Card, while PayPay Card Gold waives the ETC card annual fee; issuance limits and billing month rules apply.

Fees, Limits, and Reality Checks

Annual fees look straightforward: PayPay Card is free, while PayPay Card Gold charges 11,000 yen per year including tax.

Late fees, revolving, and installment charges follow issuer schedules; check the live fee table for exact percentages before enabling paid repayment options.

Not every transaction earns. Examples commonly excluded include PayPay balance top-ups and certain telecom charges; official pages maintain current “not eligible” lists and reflect periodic changes to what counts toward bonuses.

Practical Tips To Maximize Rewards Safely

Consistent habits push your annual earn higher without risking overspend.

- Set PayPay’s payment method to Credit when using the card to keep accrual predictable.

- Batch Yahoo and LOHACO orders on days aligned to higher earn, tracking limited-time points’ expiries.

- Aim for 30 qualifying payments and 100,000 yen monthly to trigger the +0.5% PayPay Step bonus.

- Keep 3D Secure active to reduce declines and unlock higher transaction caps in the app.

- If driving, combine Gold status with an ETC add-on for tolls without extra annual ETC fees.

Common Pitfalls and Fixes

Mismatched names between your PayPay identity record and PayPay Card profile can block PayPay Credit setup; align registered information and retry after the initial registration completes.

Some payments stopped counting for bonus accrual in 2025, including many utility bill payments via web pages or store counters; the count still advances for step conditions, but bonus awarding no longer applies to those transactions after April 2, 2025.

Support and Official References

Most account actions route cleanly through the app, including chat support during business hours.

For program rules, use PayPay’s identity verification guide, PayPay Step terms, and the PayPay Card benefit pages, which publish current rates, exclusions, and effective dates.

Last Thoughts

Foreign residents can complete PayPay Registration for Foreigners in Japan through in-app eKYC using a Residence Card or other accepted IDs, then link a bank and optionally add PayPay Card for consistent earn and full 3D Secure protection.

Verified balances enable transfers, telecom-linked Gold perks reward ecosystem users, and 2025 point rules require closer attention to limited-time point issuance and step thresholds.