This article explains how the Nationwide credit card application works and what member offers are available to you.

You will learn who can apply, what benefits members may receive, and what to expect before submitting an application.

The goal is to help you decide if a Nationwide credit card fits your financial needs.

What Is Nationwide and Who Can Apply

This section explains what Nationwide is and whether you are eligible to apply for its credit cards.

It focuses on membership status and basic application requirements.

- Nationwide Building Society – A UK-based, member-owned financial institution offering banking and credit products.

- Member-owned structure – Nationwide is owned by its customers rather than external shareholders.

- Nationwide membership – Status gained by holding an eligible Nationwide account or financial product.

- Eligible products – Accounts such as current accounts, savings, or mortgages that grant membership.

- Age requirement – Applicants must generally be 18 years old or above.

- UK residency – A basic requirement to apply for a Nationwide credit card.

- Income and affordability – Review of earnings to confirm ability to repay credit.

- Credit history – Assessment of past borrowing and repayment behavior.

- Member-only offers – Credit card deals available exclusively to Nationwide members.

Overview of Nationwide Credit Cards

Nationwide credit cards are designed to support everyday spending, balance transfers, and longer-term borrowing needs.

The range focuses on clear pricing, practical features, and offers available to eligible members.

Types of Nationwide Credit Cards

This list outlines the main categories of Nationwide credit cards and what each one is used for.

- Balance transfer credit cards – Designed to move existing card balances and manage debt with promotional rates.

- Purchase credit cards – Intended for everyday spending with standard or introductory purchase rates.

- Low-interest credit cards – Focus on reduced ongoing interest for longer-term borrowing.

- Member offers credit cards – Cards that include exclusive rates or terms available only to eligible Nationwide members.

What Are Nationwide Member Offers

Nationwide member offers refer to credit card deals linked to an active Nationwide Building Society membership.

These offers are designed to provide selected benefits that are not always available through standard applications.

- Nationwide member offers – Credit card promotions available only to eligible Nationwide members.

- Exclusive access – Offers that are not open to the general public.

- Preferential rates – Lower interest rates compared to standard credit card terms.

- Introductory promotions – Time-limited deals on purchases or balance transfers.

- Reduced fees – Possible discounts or waivers on certain credit card charges.

- Eligibility criteria – Conditions based on membership status and credit assessment.

Benefits of Applying as a Nationwide Member

Applying as a Nationwide member can give you access to specific credit card advantages linked to your membership status.

- Access to member-only offers that are not available to non-members.

- Potentially lower interest rates on purchases or balance transfers.

- Special introductory promotions for a limited period.

- Reduced or waived fees on selected credit card charges.

- Clear and transparent terms designed for existing members.

- Integrated account management through Nationwide online and mobile banking.

Interest Rates and Fees Explained

Understanding interest rates and fees helps you know the real cost of using a Nationwide credit card and plan repayments properly.

- Purchase APR – The interest rate charged on everyday card spending if you carry a balance.

- Balance transfer APR – The rate applied when you move debt from another card, often promotional for a limited time.

- Introductory rates – Temporary low or 0% interest offers that apply for a set period.

- Balance transfer fee – A one-time charge applied when transferring a balance to the card.

- Annual fee – A yearly charge on some cards, though many Nationwide cards have no annual fee.

- Late payment fees – Charges applied if a minimum payment is missed or paid late

Requirements Before You Apply

Meeting the basic requirements helps you confirm eligibility before starting the application process.

- Minimum age – You must usually be at least 18 years old.

- UK residency – Applicants are generally required to live in the United Kingdom.

- Nationwide membership – Some credit cards and offers are limited to existing members.

- Stable income – You need a regular source of income to support repayments.

- Credit history – Your past borrowing and repayment record is reviewed.

- Affordability checks – Nationwide assesses your financial situation to confirm you can manage the credit.

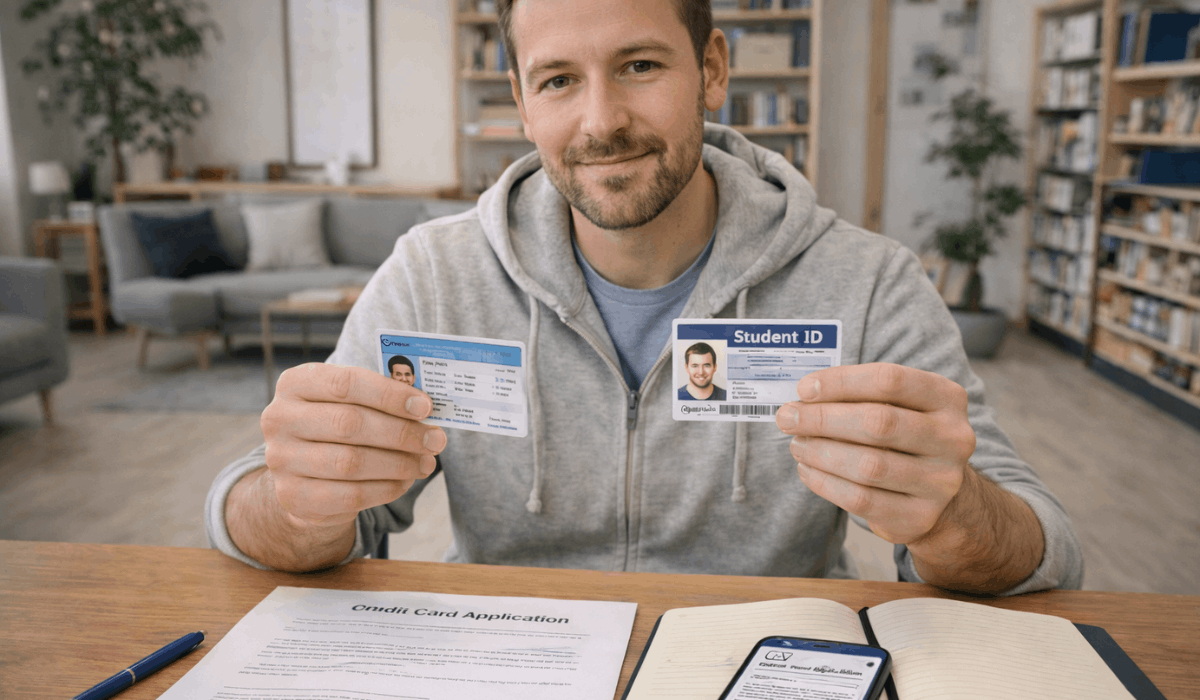

Documents You Need for the Application

Preparing the required information in advance can help you complete the application more smoothly.

- Proof of identity – Such as a valid passport or UK driving licence.

- Proof of address – Recent utility bill or bank statement showing your UK address.

- Income details – Information about your employment or regular income.

- Bank account details – Used for payments and verification purposes.

- Personal information – National Insurance number and contact details.

- Existing credit details – Information about current credit cards or loans, if requested.

Step-by-Step Nationwide Credit Card Application Process

Following the steps in order helps you complete the application accurately and understand what happens at each stage.

- Check eligibility – Review age, residency, membership status, and credit requirements.

- Choose a credit card – Select the Nationwide card that matches your spending or balance transfer needs.

- Start the online application – Enter personal, address, and contact details through Nationwide’s application form.

- Provide financial information – Share income, employment, and existing credit commitments.

- Consent to credit checks – Allow Nationwide to assess affordability and credit history.

- Receive a decision – Get an instant or short-term decision, depending on your profile.

- Accept the offer – Review terms and confirm acceptance if approved.

What Happens After You Apply

Once your application is submitted, several steps follow before you can start using your Nationwide credit card.

- Application review – Nationwide checks your details, credit history, and affordability.

- Decision notification – You receive an approval, referral, or decline outcome.

- Additional information request – You may be asked to provide extra documents if needed.

- Card production – Approved applications move to card issuance.

- Card delivery – Your credit card is sent to your registered UK address.

- Card activation – You activate the card online, by app, or by phone before use.

Contact Information

Here are verified ways you can contact Nationwide for support, including credit card enquiries and general help.

- Customer service phone (credit cards) – Call 03456 00 66 11 (UK) or +44 2476 43 89 97 from abroad for credit card support.

- Lost, stolen or damaged card – Call 0800 055 66 22 (UK) or +44 2476 43 89 96 from abroad, available 24/7.

- General phone support – For other products, dial 03457 30 20 11 (UK) or +44 1793 65 67 89 from abroad.

- Fraud reporting – Report suspicious activity at 0800 055 66 22 (UK) or via email [email protected].

- Website support & live chat – Visit the Nationwide Contact Us page and use the live chat or topic search tool: nationwide.co.uk/contact-us.

- Branch support – Visit your nearest Nationwide branch for in-person help or account questions.

To Conclude

Nationwide credit cards can offer added value when you apply as a member, especially through tailored offers and clear terms.

Understanding eligibility, costs, and the application process helps you apply with confidence and avoid surprises.

Review your options carefully and apply only when the card matches your financial needs.

Disclaimer

This content is for general information only and does not constitute financial advice.

Terms, rates, and eligibility may change, so you should always review official details before applying.