You are preparing to apply for a student credit card and need clear guidance.

The HSBC Student Credit Card is designed to help you manage expenses while starting your credit history.

This guide explains how you can apply online, what you need to prepare, and what to expect.

Who Can Apply for This Card

You must meet basic eligibility rules to apply as a student. The bank focuses on enrollment status, age, and residency.

- Currently enrolled student at a recognized university or college.

- Meets minimum age requirement, usually 18 years old.

- Legal resident of the country where HSBC offers the card.

- Valid identification and proof of student enrollment.

- No or limited credit history, suitable for first-time cardholders.

Key Features of the HSBC Student Credit Card

These features are designed to support you as a student and first-time card user. Each item focuses on control, access, and responsible use.

- Student credit limit – A modest limit set to help you manage spending and reduce risk.

- Low or no annual fee – Keeps costs manageable while you are studying.

- Online and mobile banking – Lets you track balances, payments, and activity in real time.

- Contactless payments – Allows fast and convenient everyday purchases.

- Security protection – Includes fraud monitoring and transaction alerts to enhance safety.

Benefits for Students

This card is designed to support you during your studies and early financial life. The benefits focus on control, learning, and long-term value.

- Build credit history – Helps you establish a credit record with responsible use.

- Simple expense management – Makes it easier to track and control your spending.

- Safer payments – Reduces the need to carry cash for daily purchases.

- Online account access – Allows you to monitor balances and payments anytime.

- Financial independence – Supports your transition to managing money on your own.

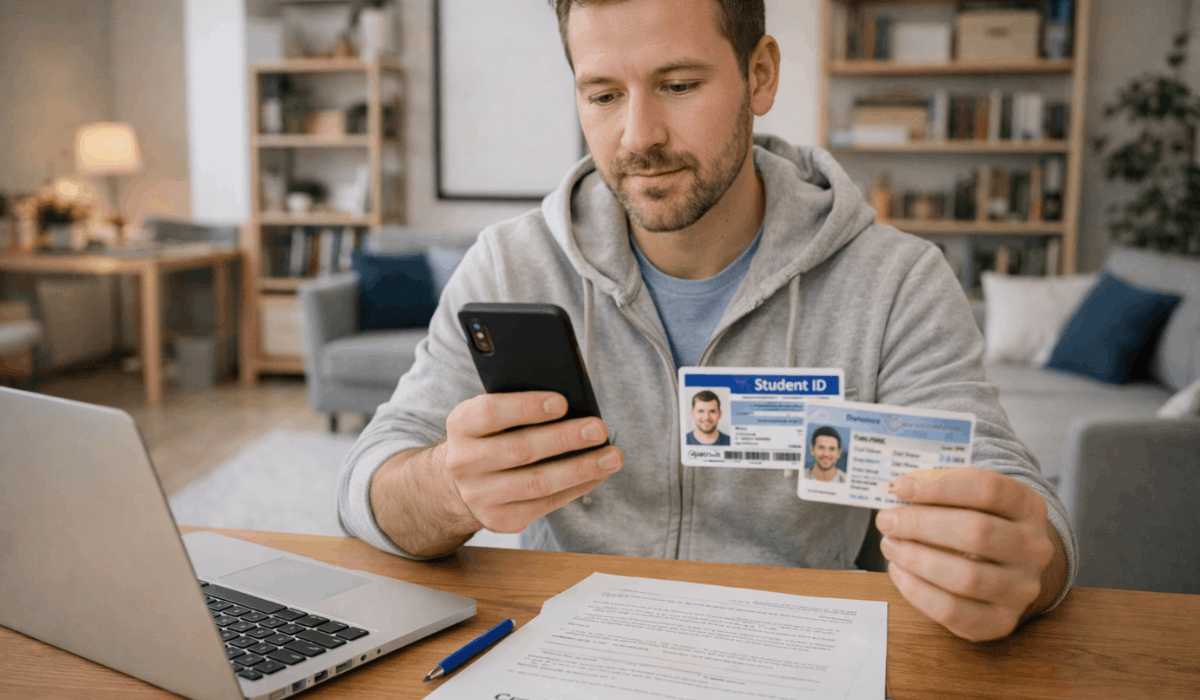

Requirements Before You Apply Online

Preparing in advance helps you avoid delays during the application. You should have your documents and details ready before starting.

- Proof of student enrollment – Confirms that you are currently studying at an eligible institution.

- Valid government-issued ID – Verifies your identity and age.

- Local residential address – Required for account registration and card delivery.

- Active email and phone number – Used for verification and application updates.

- Basic personal information – Includes full name, date of birth, and nationality.

Documents You Usually Need

You must submit basic documents to verify your identity and student status. Having these ready helps speed up approval.

- Student ID or enrollment letter – Confirms active registration at an eligible institution.

- Government-issued photo ID – Verifies your identity and age.

- Proof of address – Shows your current residential address.

- Valid email address – Used for application updates and confirmation.

- Contact phone number – Required for verification and communication.

Credit and Income Expectations

HSBC understands that students are often new to credit and may not have a steady income.

The bank focuses on basic eligibility and responsible potential rather than full credit history.

- Little or no credit history accepted – Designed for first-time credit card users.

- No full-time income required – Student status can be sufficient in many cases.

- Part-time income considered – Any regular allowance or job income may help.

- Low starting credit limits – Helps reduce risk while you build credit.

- Clean financial records preferred – Past defaults or unpaid debts can affect approval.

How to Apply for the HSBC Student Credit Card Online

The online application process is simple and designed for students. You can complete it using a computer or mobile device.

- Visit the official HSBC website – Go to the student credit card section.

- Create or log in to your HSBC account – New users must register first.

- Fill out the online application form – Enter your personal and student details accurately.

- Upload required documents – Submit identification and proof of enrollment if requested.

- Review and submit the application – Check all details before final submission.

Application Review and Approval Time

Once you submit your online application, HSBC usually takes a few business days to review your details.

The exact timeline can vary based on how complete your documents are.

- Initial review (few minutes to hours) – Some online systems check basic info quickly.

- Formal review (5–10 business days) – Most applications are processed in this timeframe.

- Extended review (up to ~2 weeks) – If HSBC needs more verification, it can take longer.

- Notification – You’ll usually get an email or SMS with the decision.

- Card delivery – After approval, physical delivery may take an additional few days.

Fees, Interest Rates, and Limits

These are the verified costs and limits for the HSBC Student Credit Card (UK version).

The exact amounts can vary by country, so always check the latest terms on HSBC’s official site.

- Annual fee – £0; there’s no yearly cost to hold the card.

- Representative APR – 18.9% variable; this is the typical interest rate charged on purchases if you don’t pay the full balance.

- Interest-free period – Up to 56 days on purchases when you repay the full balance each month.

- Credit limit – Usually up to £500, depending on your status and review.

- Cash advance fee – About 2.99% of the amount withdrawn, minimum £3.

- Interest on cash advances – Around 23.6% (variable) p.a. on cash withdrawals.

- Foreign transaction fee – Around 2.99% when used abroad or for non-sterling spending.

- Late payment fee – Around £12 if you miss a payment.

Is the HSBC Student Credit Card Worth It

This depends on how you plan to use the card and how disciplined you are with payments.

It can be worth it if you want a simple way to build credit while keeping fees low.

- Worth it if you’re building credit – Regular on-time payments can help you create a positive credit history.

- Worth it if you can pay in full – Paying the full balance each month helps you avoid interest charges.

- Worth it if you want a simple student limit – A lower limit can make spending easier to control.

- Not worth it if you carry a balance often – Interest can add up quickly if you only pay the minimum.

- Not worth it if you need travel perks – Student cards usually focus on basics, not premium rewards or benefits.

Contact Information

Here are verified ways to reach HSBC for student credit card support. Contacts vary by country, so use the one relevant to you.

- UK Customer Support Phone – General credit card help: 03457 404 404 (within UK) or +44 1226 261 010 (abroad).

- UK Non-HSBC Customer Phone – 03455 873 444 (UK) or +44 1226 261 010 (abroad).

- UK Online/Mobile Support – Live chat and mobile banking help available via the HSBC app or website help section.

- Philippines Customer Service – (02) 8858-0000 or (02) 7976-8000; toll-free +1-800-1-888-8555 for selected areas.

- Philippines Online Chat – Available daily (typically 9 am–6 pm).

- India Credit Card Support – 1800 267 3456 (toll-free within India) or +91-40-65118002/+91-22-71728002 (from overseas).

- UAE Credit Card Queries – +9714 3216834 (within and outside the UAE).

- HSBC USA Credit Card Support – 1-888-662-4722 (general US credit card customer service).

H3: Final Thoughts for Students

The HSBC Student Credit Card can be a practical option if you want to start building credit while keeping costs manageable.

It works best when you use it responsibly and pay your balance on time each month.

If this fits your needs, review the eligibility details and apply online through the official HSBC website.

Disclaimer

This article is for informational purposes only and does not constitute financial advice.

Terms, fees, and eligibility for the HSBC Student Credit Card may change, so you should always confirm details on the official HSBC website before applying.