If you want to apply for the Advanzia Bank Mastercard Gold, this article will guide you. We’ll cover everything you need to know, from the card’s benefits to the step-by-step application process.

Understanding the key details ensures you make an informed decision. Let’s get started so you can confidently proceed with your application.

Introduction to Advanzia Bank

This is a well-known European financial institution based in Luxembourg. This section briefly overviews the bank’s background, services, reputation, and contact information.

Background of Advanzia Bank

It was established in 2005 as a digital bank. Since its founding, it has specialized in credit cards and payment solutions for private and corporate clients.

The bank in Luxembourg has become a leading provider of credit cards in Europe and serves customers worldwide.

Services Offered by the Bank

The bank provides a range of financial services tailored to different needs. The bank is known for its high-interest investment accounts, which offer instant access to funds.

There are no account or transaction charges associated with these accounts. The bank specializes in credit card solutions.

Reputation and Customer Service in Germany

It has built a strong reputation in Germany and across Europe. Its focus on customer satisfaction has earned it high service quality ratings. The bank is known for its flexibility in adapting to customer needs and market changes.

Customer service is a key priority, with support available in multiple languages. The bank’s commitment to excellence and diversity reflects its customer service approach. Many German customers appreciate the bank’s quick response times and helpful support team.

How to Contact Advanzia Bank?

Reaching Advanzia Bank is straightforward and convenient. Below are the essential contact details for inquiries or assistance.

Telephone Number

Advanzia Bank offers a toll-free number for customers in Germany. You can reach customer support by dialing 0800 880 1120.

Physical Address

The bank’s main office is located in Luxembourg. The address is 9, Rue Gabriel Lippmann, L-5365 Munsbach, Luxembourg.

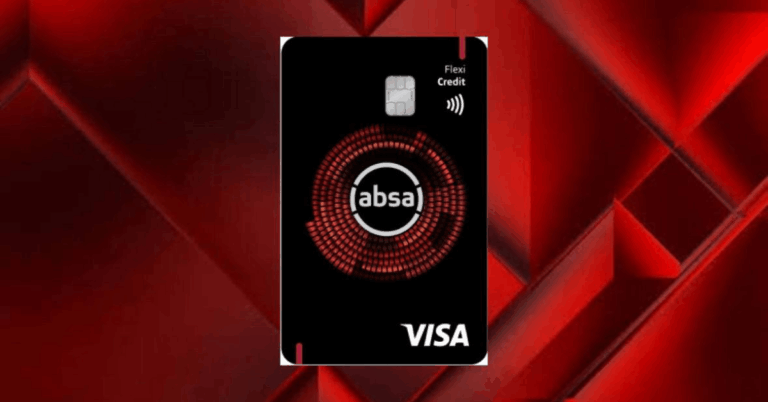

Key Features of the Mastercard Gold

This section highlights the essential features of the Mastercard Gold, helping you understand what makes it a strong option for cardholders.

No Annual Fee

This credit card has no annual fee, making it a cost-effective choice. You can use the card without worrying about yearly charges.

Worldwide Acceptance

Mastercard Gold is accepted at over 35 million locations worldwide and can be used at two million ATMs.

Flexible Payment Terms

You can enjoy interest-free payment terms for purchases. This allows you to manage your expenses with added flexibility.

Travel Insurance Included

This credit card comes with travel insurance as an added benefit, which offers peace of mind during trips.

Additional Perks

Cardholders can benefit from various discounts and offers linked to Mastercard Gold. There are also no fees for cash withdrawals or using the card abroad, adding to the card’s convenience.

Interest Rates and Fees

Understanding the interest rates and fees associated with Mastercard Gold is essential for managing your finances effectively. This section breaks down these costs.

Overview of Interest Rates

This part explains how interest rates work with this card. Knowing the rates helps you plan your payments wisely.

Standard Interest Rate

The standard interest rate applies when you carry a balance on your card. This rate is competitive and similar to other credit cards. It’s essential to pay attention to this rate if you don’t pay your balance in full.

Interest-Free Payment Period

This card offers an interest-free period on purchases. You won’t be charged any interest if you pay your balance within this period. This benefit allows you to manage short-term expenses without additional costs.

Late Payment Fees

A late fee will be applied to your account if you miss a payment. This fee is fixed and added to your next statement. Late payments can also lead to higher interest charges on your outstanding balance. It’s important to make payments on time to avoid extra costs.

How Is Interest Calculated?

Interest on the Mastercard Gold is calculated daily on your outstanding balance. The rate is applied to any unpaid amount after the interest-free period. It’s important to understand that interest compounds, meaning the longer you carry a balance, the more interest you’ll pay.

Comparison with Other Credit Cards in Germany

When comparing the Mastercard Gold to other credit cards in Germany, you’ll find it offers competitive interest rates. Unlike some cards, it provides an interest-free period for all purchases. Additionally, there are no fees for opening, managing, or closing your account.

Eligibility Criteria for Application

Before applying for this card, you must meet specific eligibility criteria. This section outlines the basic requirements.

Age Requirement

Applicants must be at least 18 years old to apply. This ensures that you are legally able to enter into a credit agreement. Age verification is part of the application process.

Residency Requirements

You must be a resident of Germany or another eligible European country. This is necessary for both legal and administrative reasons. Proof of residency may be required during the application process.

Credit Score Considerations

Your credit score will be evaluated as part of the application. A good credit score increases your chances of approval. The bank uses this information to assess your ability to manage credit responsibly.

Necessary Documentation

Certain documents are required to complete your application. Make sure you have these ready to avoid any delays.

Proof of Income

You must provide proof of income, such as a recent payslip or tax return. This helps the bank assess your financial stability. The documentation ensures you can manage the credit limit offered.

Identification Documents

A valid ID or passport is required to verify your identity. This step is crucial to prevent fraud and ensure your application is processed smoothly. Make sure your identification is up to date.

Step-by-Step Application Process

Applying for the Mastercard Gold is simple and can be done online or through alternative methods. Here’s a brief guide to help you.

Online Application Process

Applying online is quick and easy. Follow these steps.

How to Fill Out the Application Form

Complete the form by:

- Accessing the form on the official website.

- Entering your details like name and address.

- Submitting the form after reviewing.

Uploading Necessary Documents

Upload your documents online with these steps:

- Scan or take photos of required documents.

- Upload them in the specified sections.

- Confirm the upload before submission.

Alternative Methods to Apply

If you prefer to do something other than apply online, here are other ways.

Telephone Application

Apply over the phone by:

- Calling customer service using the provided number.

- Give your information to the representative.

- Following their instructions to complete the process.

Mail-in Application

Apply by mail by:

- Requesting or downloading the form.

- Fill it out with your details.

- Mailing it with the required documents to the given address.

Verification and Approval Timeline

After submitting, your application goes through these steps:

- Initial review within a few days.

- Verification of your documents and information.

- Approval or additional requests sent to you.

What to Expect After Approval?

Once approved, here’s what happens:

- Receive your card in the mail.

- Activate it as instructed.

- Start using it and manage your account online.

Disclaimer: Information may change over time. For the latest updates, visit the official website.

Final Summary: Getting the Advanzia Bank Mastercard Gold

Applying for the Advanzia Bank Mastercard Gold is straightforward and offers various benefits, like no annual fee and worldwide acceptance. Following the steps outlined, you can quickly complete your application and enjoy the perks.

Prepare all necessary documents and understand the interest rates and fees involved. This card is a solid choice for those looking for flexibility and added features to their credit card.